SaaS

The three hidden traps of subscription billing

Everyone loves the idea of recurring revenue. It feels predictable, scalable, and safe.

But having built and scaled payment infrastructures for years, I have seen the same story play out repeatedly. Teams treat subscriptions as a simple "charge $50 every month" cron job.

They forget that the relationship with the customer is dynamic. Cards expire, users upgrade halfway through the month, and usage fluctuates.

If you treat billing as a static script, you are building a house of cards.

Here are three subscription challenges that will break your operational flow and how to fix them practically.

The Dunning Nightmare (Payment Failures)

We often assume that when a payment fails, the customer wants to leave.

That is rarely the case. Involuntary churn where a payment fails due to expired cards, bank declines, or insufficient funds, accounts for a massive chunk of lost revenue.

The Damage:

You cancel the user’s access immediately, disrupting their business.

Support teams get flooded with angry tickets asking why the service stopped.

You lose revenue from a customer who actually intended to pay.

Do this instead:

Implement a "grace period" logic. If a payment fails, do not cut access instantly. Set up a smart retry schedule (e.g., retry on day 1, day 3, and day 7). Send a simple, plain-text email notifying the user of the failure with a direct link to update their method. Treat a failed payment as a communication opportunity, not a breakup.

Proration Pitfalls (Mid-cycle changes)

This is where I see most "custom-built" billing engines fail.

A user is on the Basic Plan ($10/month). On day 15, they upgrade to the Pro Plan ($20/month). If you do not handle this mathematically, you either undercharge the user or overcharge them, creating a billing surprise. As discussed in previous posts, users feel tricked when costs appear unexpectedly.

The Damage:

Accounting becomes a mess because invoices do not match revenue recognized.

Users feel cheated if they are charged the full price for both plans in the same month.

Developers waste sprints trying to calculate "unused time" versus "used time."

Do this instead:

Keep the logic simple: Unused time on the old plan becomes a credit.

When they upgrade, calculate the remaining value of the Basic Plan and apply it as a discount to the immediate charge of the Pro Plan. Do not try to invent your own proration algorithm. Use the logic already present in payment providers like Stripe or Adyen. If you are building this manually, you are prioritizing the wrong things.

Metered Usage Discrepancies

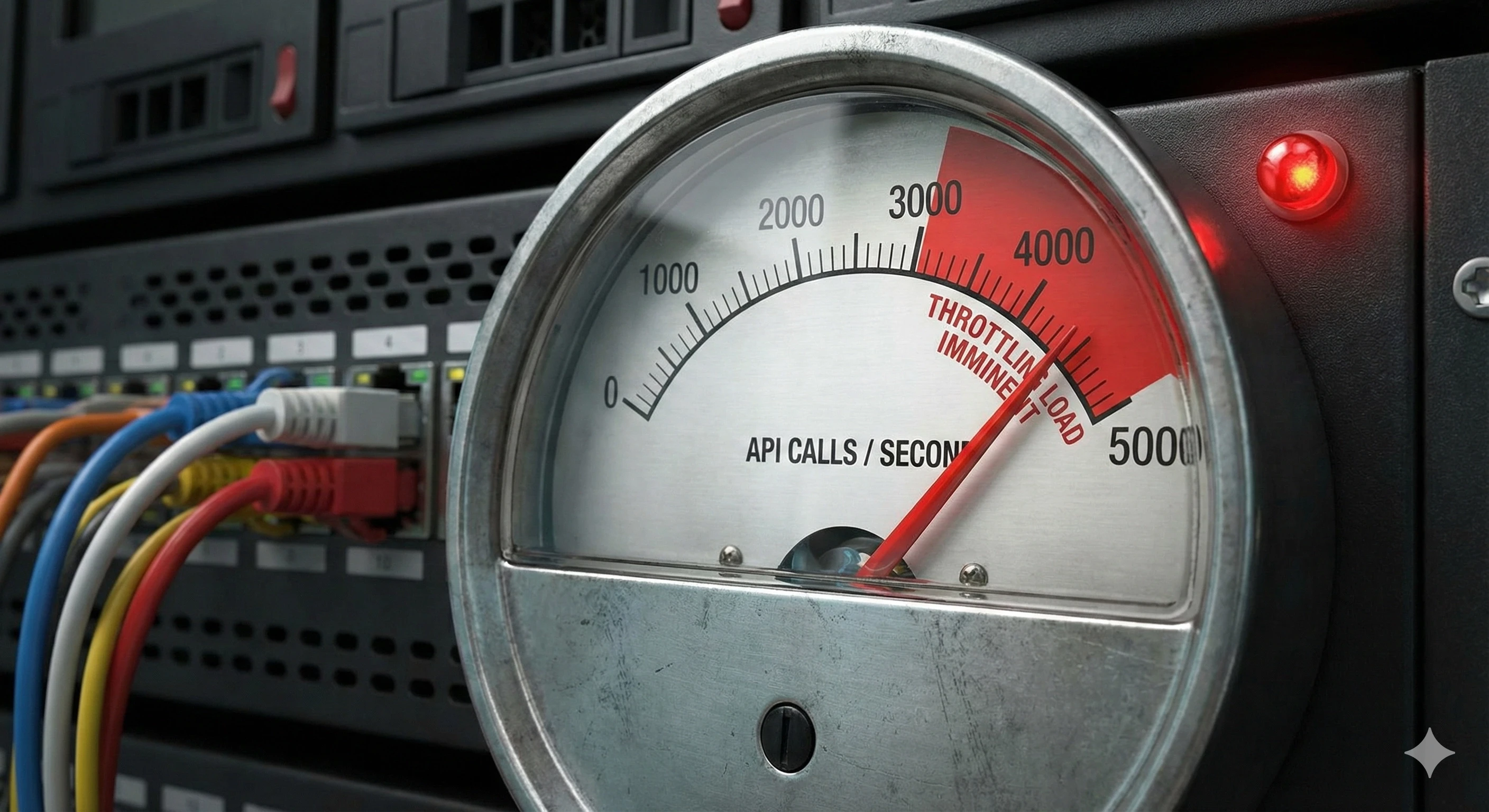

Pay-as-you-go models (charging per API call, per active seat, or per gigabyte) are becoming the standard in B2B. The trap here is synchronization. Your app knows the usage, but your billing system finds out too late.

The Damage:

Bill Shock: The user receives an invoice for $5,000 when they expected $500 because no alerts were triggered.

Revenue Leakage: You fail to track usage during a system outage or downtime, giving away services for free.

Do this instead:

Decouple usage tracking from billing calculation.

Your application should simply emit "usage events" (e.g., api_call_made) to a database or a ledger. Do not calculate the cost in real-time.

At the end of the billing cycle, aggregate these events and apply the price. This allows you to audit the usage later if a customer complains.

Also, set up "hard limits" or "soft alerts" for your users. If a customer typically spends $100 and suddenly spikes to $1,000, notify them. It builds trust, and trust retains users far better than a refund policy ever will.

Summary

Building a subscription model is not just about the code; it is about the lifecycle of the customer.

Don't let payment failures kill your retention, and don't let billing logic consume your engineering resources. Keep it practical, handle the edge cases early, and respect the user's wallet.

Related Articles